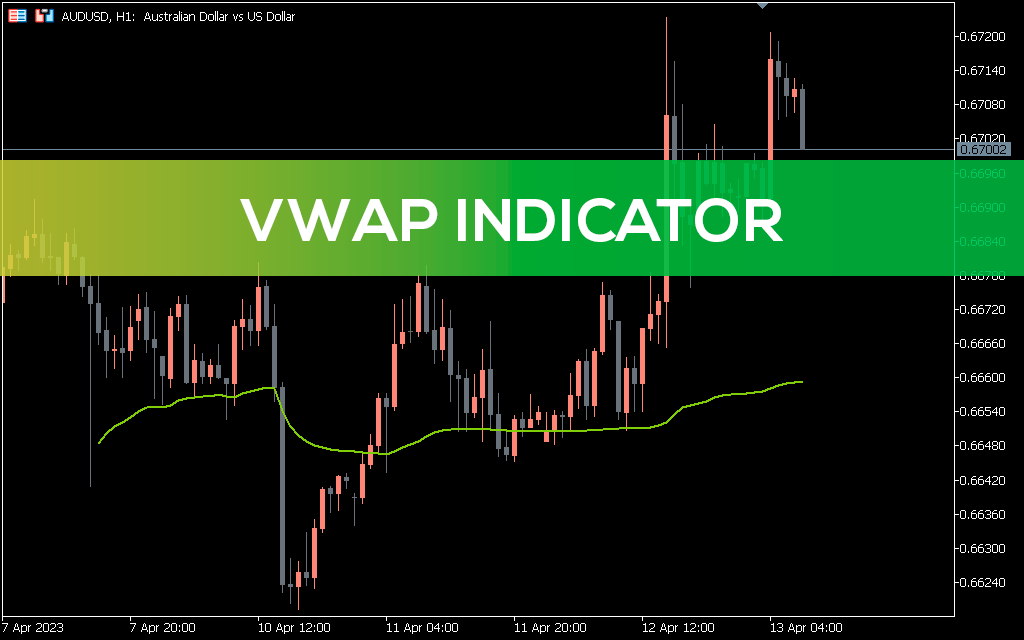

VWAP (Volume Weighted Average Price) stands for Volume-Weighted Average Price. In forex trading, it’s used to measure the average price of a currency pair weighted by trading volume over a specific period (usually intraday).

Even though forex is decentralized (no single central exchange volume), many brokers and platforms like MT4/MT5 provide tick volume–based VWAP, which still works well for intraday analysis.

📊 What VWAP Is Used For in Forex

1️⃣ Intraday Trend Direction

VWAP helps traders see whether price is trading:

Above VWAP → bullish intraday bias

Below VWAP → bearish intraday bias

Example:

If EUR/USD is trading above VWAP during London session, buyers are in control for that session.

2️⃣ Dynamic Support & Resistance

VWAP often acts as:

📌 Support in uptrends

📌 Resistance in downtrends

Price frequently pulls back to VWAP before continuing the trend.

3️⃣ Fair Value / Institutional Benchmark

VWAP shows the “fair price” for the day.

Institutional traders often aim to:

Buy below VWAP

Sell above VWAP

If you trade with larger lot sizes (like on platforms such as Exness), VWAP can help avoid entering at overextended prices.

4️⃣ Scalping & Session Trading

VWAP works best for:

London session trading

New York session trading

Intraday scalping

It resets daily, so it's not ideal for long-term swing trading.

5️⃣ Mean Reversion Strategy

If price moves too far away from VWAP:

It may revert back toward VWAP

Traders use VWAP bands (like Bollinger Bands around VWAP)

📌 Simple VWAP Trading Setup Example

Buy Setup:

Price above VWAP

Pullback to VWAP

Bullish confirmation candle

Stop below VWAP

Sell Setup:

Price below VWAP

Pullback to VWAP

Bearish confirmation

Stop above VWAP

⚠️ Important Notes for Forex Traders

Forex VWAP is based on broker volume, not centralized exchange volume.

Works best on lower timeframes (M1–H1).

Should be combined with:

Market structure

Session timing

Support/resistance

RSI or MACD confirmation

🎯 Who Should Use VWAP?

✔ Scalpers

✔ Day traders

✔ Traders who follow institutional flow

❌ Long-term swing traders